Cognitive Index 03| From Frameworks to Foresight

When consulting stopped advising and started becoming software

The Rise of Systems That Turn Advice Into Architecture

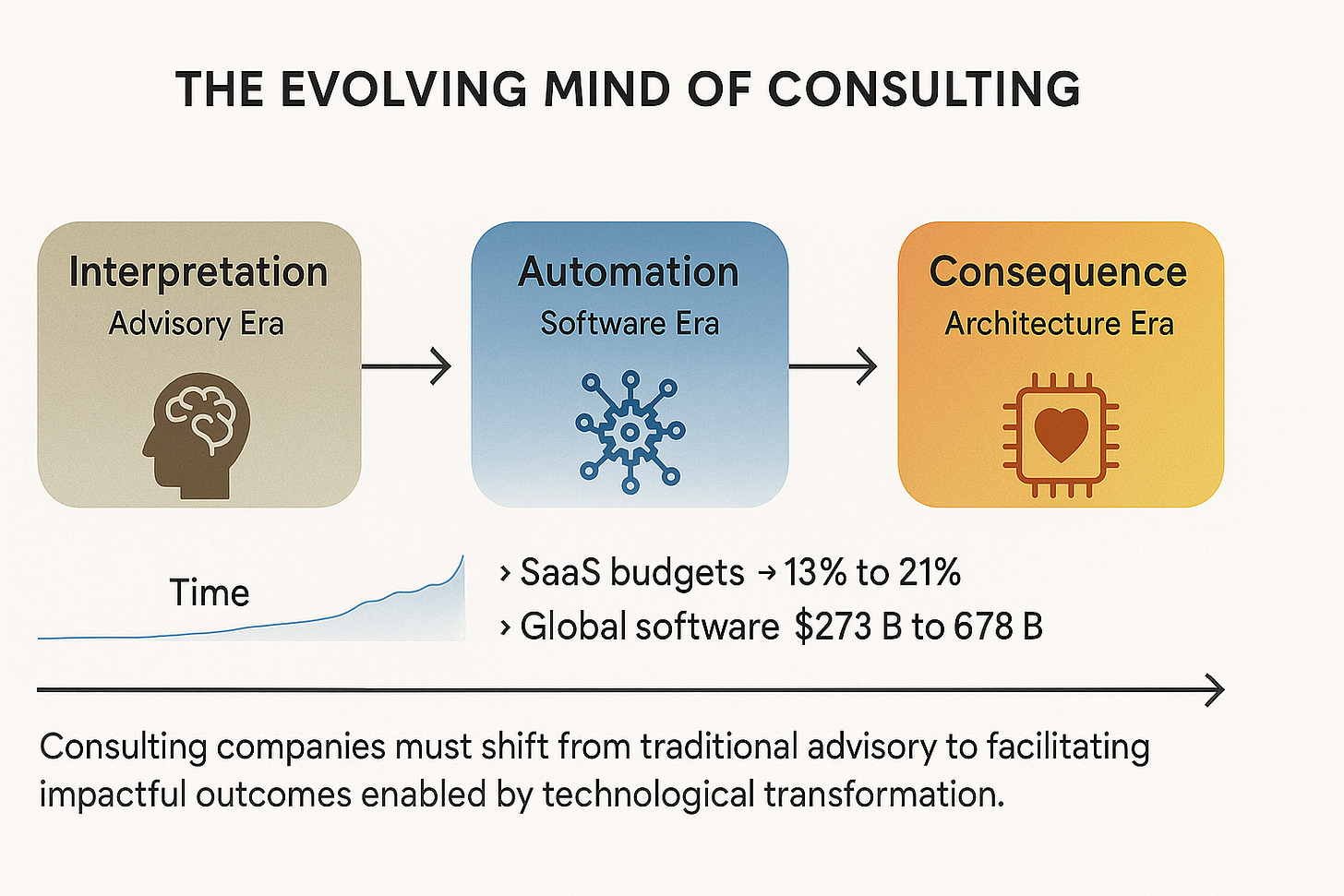

I’ve been thinking about how quietly the foundations of the consulting world are shifting. For decades, firms sold interpretation — frameworks, playbooks, and polished wisdom — translating complexity into meaning.

But I believe most companies today don’t need interpreters. They need instruments. Dashboards have replaced deliverables. Agentic AI models summarize 200-page reports in minutes. What clients ask now is no longer “What should we do?” but “Can you make it work by next quarter?”

And that single shift has changed everything.

The Age of Advisory Is Ending

Between 2019 and 2024, the share of global IT budgets spent on SaaS tools jumped from roughly 13% to 21% — a clear signal that enterprises are now buying execution capacity instead of consulting hours. The global software-consulting market, where advisory meets build, stood at around US $273 billion in 2022 and is projected to reach over US $678 billion by 2030 (CAGR ≈ 12%).

I feel this marks a deep cultural inflection point. The client today has no appetite for abstraction. They don’t pay for frameworks; they pay for function. And that’s a profound shift — from interpretation to instrumentation.

The Evolution of Consulting — tracing the shift from frameworks to functions to foresight. The age of advisory gives way to systems that think, learn, and deliver measurable consequence.

The SaaS Paradox

Ironically, even the software industry — once the disruptor of consulting — now faces its own disruption. Low-code and no-code ecosystems are exploding: the market is forecast to grow from about US $28 billion in 2024 to nearly US $264 billion by 2032, a CAGR exceeding 32%. In a 2024 national survey, 84% of technology leaders said they rely on SaaS platforms with low-code features, yet most reported serious integration challenges.

I think this new abundance of creation tools has created its own paradox: the more tools we have to build, the less time we seem to have to think.

The next shockwave comes from agentic AI — autonomous models that don’t just analyse but act. That market, valued at about US $5.4 billion in 2024, is projected to exceed US $50 billion by 2030, expanding almost 46% annually. These systems can run market simulations, manage workflows, and generate competitive analyses overnight. They don’t advise; they execute.

But SaaS vendors are discovering their own limit. A 2025 AlixPartners study noted that over 100 publicly traded mid-market software firms are being squeezed by AI and automation, their once-defensible products suddenly generic. The very forces that made SaaS dominant are now eroding its margins.

I feel that’s the irony of innovation — disruption never pauses long enough to admire its own work. Consulting is turning into software, and software is struggling to stay special.

The Expanding Architecture of Consulting

I believe this transformation isn’t confined to growth or strategy advisory. Whether it’s functional consulting — in IT, marketing, revenue operations, HR, or supply chain — or industrial consulting across healthcare, energy and power, mobility, semiconductors, chemicals and materials, aerospace, CPG, TMT, or financial services, etc. all are converging along the same evolutionary curve: from reports to data, from data to SaaS, and from SaaS to AI.

At the center of it all sits data — the nucleus that binds industries, functions, and geographies into one measurable fabric of intelligence.

I feel each consulting discipline is now measured not by its narrative but by its outcomes:

HR Consulting → measurable hiring outcomes, predictive retention, and AI-driven workforce analytics (Mercer, Korn Ferry, Deloitte Human Capital).

IT Consulting → automation, cloud orchestration, and digital resilience (Accenture Cloud First, IBM Consulting, Capgemini, Cognizant Digital).

Marketing Consulting → precision metrics like ROAS, SQL conversions, and inbound/outbound ratios (Deloitte Digital, Publicis Sapient, WPP Group).

Customer Experience management (CXM) & Customer Success Consulting → measurable customer health and retention, NPS automation (PwC Experience Center, TCS Interactive, Adobe Experience Cloud integrators).

Supply Chain Consulting → throughput, forecast accuracy, and carbon impact (BCG, EY Ops Transformation, Kinaxis, Blue Yonder).

Industrial Consulting → sectoral expertise in healthcare, power, aerospace, semiconductors, and materials evolving into AI-led simulation and optimization systems (McKinsey, BCG, Roland Berger).

The Platformization of Consulting

What’s even more striking is how the world’s largest consultancies are already rebuilding themselves as platform ecosystems — not firms that advise, but systems that learn.

Accenture’s SynOps and myConcerto platforms blend automation, AI, and analytics into living operational engines — transforming static consulting frameworks into continuously updating architectures of execution.

McKinsey’s QuantumBlack has evolved into a foresight fabric of its own — embedding predictive models directly into client workflows, turning “insight delivery” into “self-learning decision systems.”

BCG X merges design, engineering, and AI-driven modeling to construct hybrid platforms that can iterate on market change without manual reinvention — essentially turning the firm’s intellectual capital into executable code.

Even PwC’s Halo and EY Fabric are no longer internal toolkits but full-fledged ecosystems — enabling clients to track value realization in real time, reducing the interpretive gap between strategy and system.

Each of these efforts marks a fundamental rewiring of consulting’s identity:

the transition from playbooks to platforms, from reports to recurrence, and from deliverables to distributed intelligence.It’s the emergence of Consulting-as-Software — the natural midpoint between advisory and automation, and the foundation for the consequence economy that follows.

The Consulting Convergence Spiral — illustrating how functional and industrial consulting domains converge into measurable consequence. Every system — from HR to Supply Chain — now revolves around a single nucleus: data, SaaS, and AI powering the architecture of outcomes.

Beyond the functional and industrial verticals, a quieter evolution is reshaping the consulting core itself — the research and intelligence disciplines that once powered every strategic decision.

Investment Research & Analytics is moving from static equity insights to algorithmic market mapping, where fund managers and analysts track real-time portfolio signals rather than quarterly outlooks.

Growth Advisory — once limited to TAM, GTM, and Voice of Customer study reports — now runs on dynamic intelligence frameworks that model live demand shifts and customer sentiment through AI-driven foresight engines.

Valuation & Financial Advisory has become predictive and simulation-based, using scenario engines that stress-test deals, capital strategies, and financial restructures before execution.

IP & Technology Research is rapidly morphing into a system of automated innovation scouting — identifying patents, trends, and emerging technologies through cognitive search and generative mapping models.

Together, these spheres represent the foundation layer of modern consulting — where intelligence itself is becoming continuous. The firm no longer merely interprets data; it learns, iterates, and builds its own epistemology.

I think this evolution forms a consulting flywheel — where every domain, from HR to Supply Chain to Marketing, spins toward the same center: measurable consequence. What used to be expertise is now engineered experience, and the next frontier of consulting will be defined not by frameworks, but by foresight and architecture.

The Architecture of Consequence

If information can be automated, then meaning becomes the only scarce resource.

That’s where the next generation of enterprises — consulting or software alike — will live: not in advice, not in licenses, but in architecture.

I think consequence is the new currency of credibility.

It’s measured not in hours or headcount but in transformation density — how much a system actually changes per iteration.

Advice was interpretive.

Software was operational.

Consequence is architectural.

It sits at the intersection of thinking and building — the human capacity to embed purpose into function.

That’s why I believe the winners of this decade will not be consultants or coders, but constructors of consequence — people and firms that design reality, not commentary.

The next institutions won’t sell time or tools; they’ll sell gravity.

Signature Calculation | The Consequence Equation

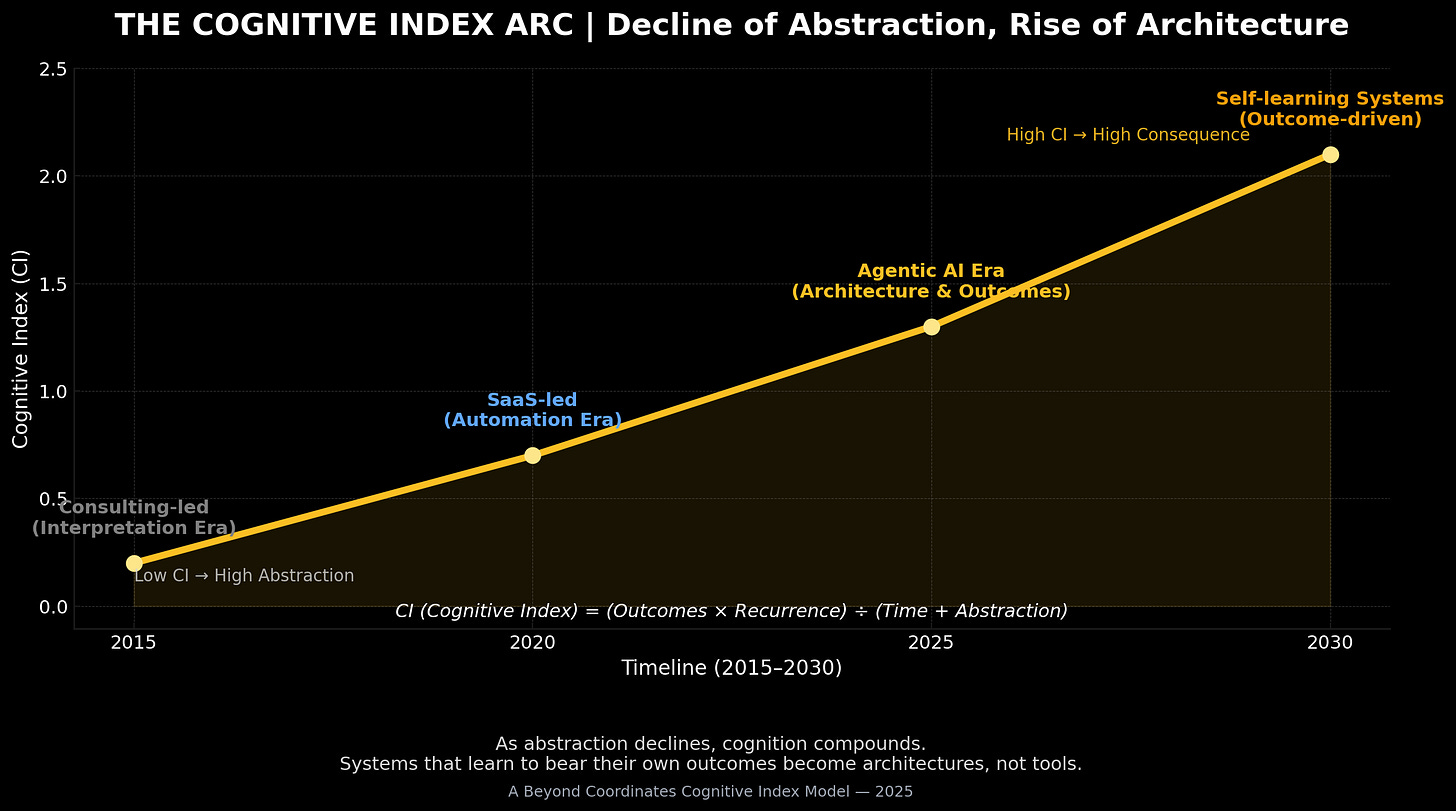

Consequence Index (CI) = (Measurable Outcomes × Recurrence) ÷ (Time Spent + Human Abstraction)

Example:

Outcomes score = 0.45; Recurrence = 4; Time + Abstraction = 140.

CI = (0.45 × 4) ÷ 140 = 1.8 ÷ 140 = 0.0129 → Scaled per 100 hours = 1.29.

Higher CI means higher consequence density and lower interpretive drag.

The Consequence Arc and Evolution Timeline:

As abstraction falls, consequence compounds.

The future belongs not to those who build faster systems,

but to those who design ones that endure their own intelligence.

The Consequence Arc — a timeline showing the fall of abstraction and the rise of measurable architecture. As frameworks evolve into foresight systems, consequence becomes the new currency of credibility.

Methodology & BC Signature Calculation

At Beyond Coordinates, we define the Cognitive Index (CI) as a narrative metric that captures the balance between measurable outcomes and human abstraction.

It helps evaluate how systems — from consulting frameworks to agentic AI — convert insight into realization.

The index applies uniformly across both functional and industrial consulting domains — quantifying how each transforms intelligence into measurable consequence.

The formula is not mathematical dogma but a lens to measure the realization efficiency of work systems.

Higher CI reflects greater autonomy, faster iteration, and tangible outcomes.

Lower CI reflects higher abstraction and interpretive drag.

The Cognitive Index Arc — Beyond Coordinates’ signature framework to quantify the realization efficiency of consulting, SaaS, and AI systems. It measures how human abstraction converts into measurable consequence.

Bridge to The Atoms of Power

In truth, every measurable outcome now runs on compute, and every compute on power.

Consulting’s evolution, like every industry, is bounded by the grid.

In our next essay, The Atoms of Power, we follow this current — exploring how the world’s energy architecture is quietly becoming the new infrastructure of intelligence.

Closing

In the end, perhaps the question isn’t who will build faster systems — but who will design the ones that still mean something.

© Beyond Coordinates, 2025.

The Cognitive Index and derivative analytical systems are part of the Beyond Coordinates Ecosystem.

🧾 Sources & References

Gartner (2024): Global Enterprise IT Spending Report. — SaaS budget share increased from 13% (2019) to 21% (2024).

Fortune Business Insights (2023): Software Consulting Market Size & Forecast 2022–2030.

Grand View Research (2024): Low-Code/No-Code Development Platform Market Report.

Statista (2025): Enterprise SaaS Adoption & Integration Challenges Survey.

AlixPartners (2025): Mid-Market Software Profitability Study.

Accenture (2024): SynOps & myConcerto Platform Documentation.

McKinsey & Company (2024): QuantumBlack Applied Intelligence Overview.

Boston Consulting Group (2024): BCG X Initiative Portfolio.

Markets & Markets (2023): Growth Advisory Case Studies and TAM/GTM Modeling Frameworks.

Aranca (2023): Voice-of-Customer Research & Market Intelligence Integration Models.

Grand View Research (2023): Agentic AI Systems & Workflow Automation Report.