The Third Pole: India, China, the GCC, Russia & Africa in a Changing World

As BRICS+ rises, NATO strains at the edges, and the INSTC quietly links continents, I feel the world’s pulse shifting toward the Global South.

“Power doesn’t disappear. It moves to wherever decisions, resources, and capabilities quietly align.”

— Beyond Coordinates

Dispatches | By Beyond Coordinates

Δ ▽ ⧋

I’ve been observing these shifts for some time now, and I’ve started to believe the world is quietly redistributing its weight. Not through dramatic collapses or loud geopolitical announcements — but through corridors, minerals, currency choices, and the slow realignment of interests. As per my analysis, these movements are forming what I call the Third Pole: a pragmatic southern axis pulled together by necessity, geography, and long-term strategy across Asia, the Middle East, Africa, and Eurasia.

Video courtesy of Zeihan on Geopolitics, YouTube Channel

The West’s Softening Grip

When I look at the West right now, I don’t see collapse — I see erosion. A thinning. Europe’s challenges feel structural: declining populations, expensive energy after years of dependence on Russian supply, industries losing competitiveness, and political cycles too short for real strategic continuity. Europe still functions, yes — but the cohesion that gave it weight feels lighter.

Across the Atlantic, the United States remains powerful, innovative, and influential. But I feel it’s stretched across too many theatres: Europe, the Middle East, the Pacific, and domestic pressures pulling inward. It isn’t losing capability, but it is losing focus. Dispersion reduces grip, even without decline.

For the first time in decades, the global center is not automatically the Atlantic.

It’s loosening.

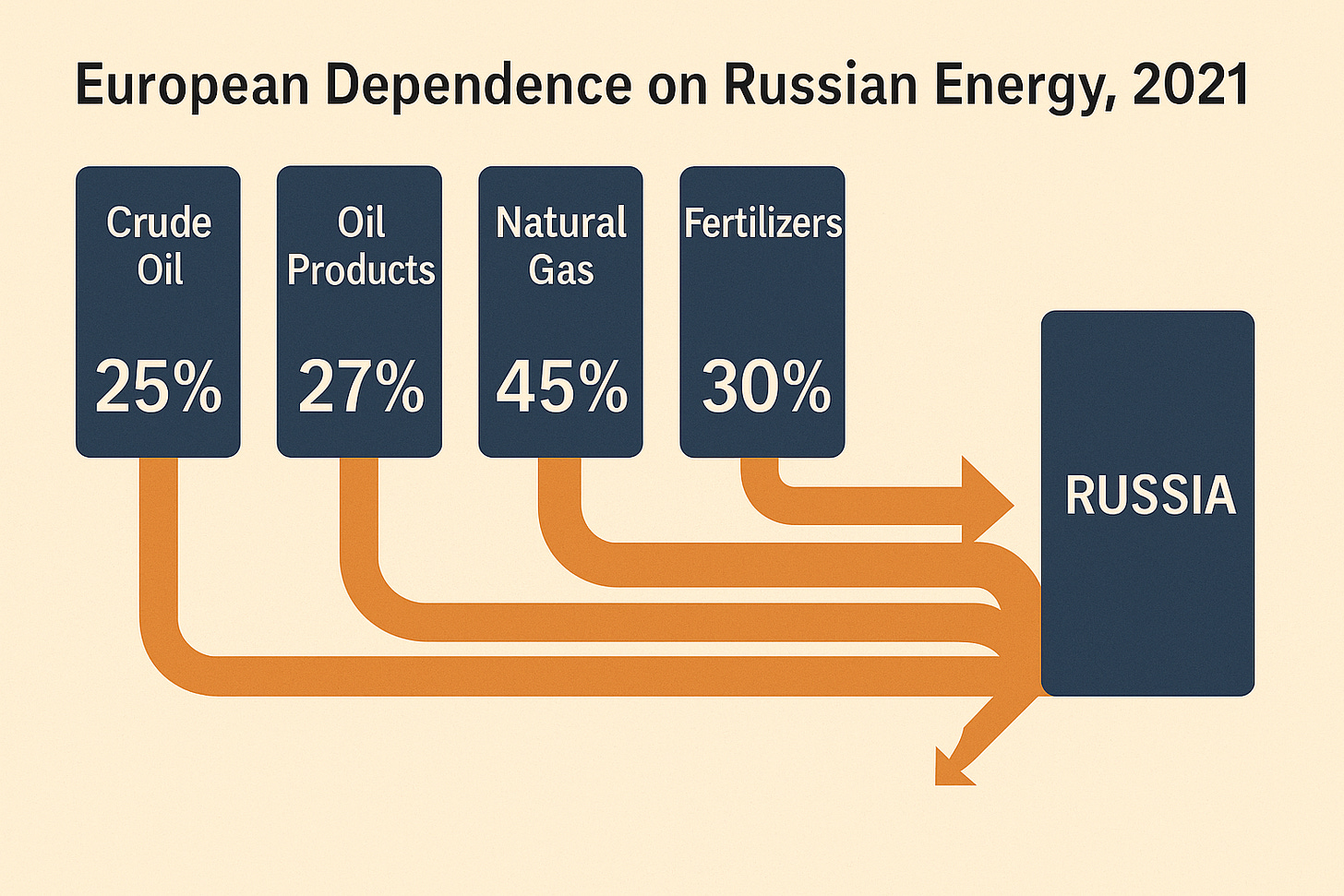

Infographic | Europe’s Dependence on Russian Energy and Fertilizers (2021–2024)

Data: Eurostat, IEA, World Bank (2024)

Before sanctions, Russia supplied roughly 45% of EU natural gas, 27% of oil products, 25% of crude oil, and nearly 30% of fertilizers.

Despite diversification efforts, Europe remains structurally tied to Eurasian energy and raw-material chains.

The West isn’t collapsing.

It’s simply no longer the only center that holds everything together.

Structural Pressure Points in the West

I sometimes feel the West’s internal pressures are deeper than what the headlines capture. Europe’s ageing population and sub-replacement fertility rates make its social model hard to sustain. Welfare systems are supporting more people than the working-age base can carry, and this imbalance is not reversing. Most major economies in Europe are sitting at fertility levels between 1.2 and 1.5 — well below replacement — which means fewer workers, higher pension burdens, and constant pressure to import labour.

The U.S., for its part, still dominates innovation, but a lot of that edge comes from Asian technocratic talent — Indian engineers, Chinese and Taiwanese researchers, immigrants running labs, startups, and AI teams. Even America’s defence and manufacturing base relies on globalized supply lines while its military-industrial complex consumes 3–4% of GDP. In a more fragmented world, this dependency becomes a structural vulnerability.

When you combine NATO’s overstretch, Europe’s demographic realities, and a U.S. economy that leans heavily on immigrant expertise — and the picture becomes clearer: the West hasn’t collapsed, but its dominance is thinner than before and it’s not surprising to see other regions gaining relative weight.

China’s Upstream Control

China’s power doesn’t come from ideology — it comes from upstream control. When I analyze China’s behavior, I keep coming back to the same conclusion: China built leverage where others didn’t bother looking.

It dominates the essentials:

rare-earth processing,

battery metals,

port and maritime supply chains,

semiconductor pathways,

and rapidly growing AI-compute capacity.

These aren’t flashy assets. They’re structural ones. China positioned itself where global industries bottleneck — and that gives it long-range influence.

China’s strategy has never been to control the whole world.

It is to become unavoidable to the world.

India’s Diplomatic & Digital Architecture

India, meanwhile, is rising through a different approach — one I think more nations are comfortable leaning into. India’s strength is the combination of digital public infrastructure, diplomatic balance, demographic scale, and a stable political arc.

What stands out to me is India’s ability to keep relationships open across blocs. It doesn’t alienate the West, nor does it fall into China’s orbit. It negotiates from its own center. The creation of the Dakshin Global South Centre signals something new: India is ready to speak on behalf of the Global South in its own voice.

India’s emerging role as a settlement hub linking Rupee-based trade with Russia, China, and the Gulf, amid the gradual erosion of U.S. dollar dominance.

Data: IMF, SWIFT, BRICS Secretariat (2025) | Design: Beyond Coordinates

I believe India’s role is less to dominate and more to harmonize — to prove that stability can itself be a form of strength.

INSTC: India’s Re-entry Into Eurasia

INSTC — the India–Iran–Russia International North–South Transport Corridor — is one of the most misunderstood strategic developments of this decade.

It isn’t just a faster route.

It’s a geopolitical correction.

Every time I study INSTC, I see:

reduced dependency on narrow chokepoints,

direct Indian access to Russia and Central Asia,

lower freight times,

and the transformation of India’s continental positioning.

I feel INSTC quietly rewires India’s presence in Eurasia.

It brings India into the northern trade spine in a way no previous infrastructure allowed.

Africa’s Currency Experiments

Africa is experiencing early but meaningful financial shifts. Kenya and Tanzania trading in their own shillings; Nigeria and Ghana experimenting with naira–cedi settlement; southern Africa deepening rand-based networks.

Individually these moves seem small.

Taken together, they show intent.

Africa is no longer accepting total dependency on external currencies. And with AfCFTA enabling continent-wide trade integration, Africa is preparing to negotiate from a position of agency.

This matters for the Third Pole — the South wants to trade with the South, not through someone else’s lens.

The Gulf: Capital + Logistics + Patience

If there is a region holding this southern realignment together, it is the Gulf.

Saudi Arabia, the UAE, and Qatar have built a rare combination:

long-horizon capital,

world-class logistics,

diversified energy strategy,

and flexible diplomacy.

What I personally find impressive is how the Gulf avoids ideological anchoring. Their goal is stability and strategic depth, not political inheritance. They place calculated bets — in Africa, in India, in Central Asia — and they think in decades.

The Gulf gives the Third Pole momentum, connectivity, and money — the three elements every emerging axis needs.

Russia: The Material Intelligence of Power

Russia is often described in political terms, but when I strip that away and look only at fundamentals, I see something clearer: Russia is the material base of this emerging southern system.

Economic & Industrial Spine

GDP ≈ $2.3T

Oil & gas ≈ 60% of exports; ≈ 30% of budget revenue

Wheat, barley, and fertilizer exports sustaining Asia & Africa

Critical minerals like palladium, nickel, titanium, uranium, and rare metals essential for EVs, AI hardware, aerospace, and chips

Defence & Transfer Networks

≈ 4.8% of GDP spent on defence

2nd largest global arms exporter

Deep technology-transfer links with India, Vietnam, Algeria, Sub-Saharan Africa

Submarines, missile systems, aircraft platforms, and licensed production

Geo-economic Re-routing

Pipelines redirected toward Asia

Ruble–Yuan and Ruble–Rupee settlement corridors

BRICS digital currency pilots

Russia provides matter.

China converts matter into systems.

India stabilises and mediates.

The Gulf funds and connects.

Africa grows and becomes the demand engine.

The Third Pole is not ideological.

It is functional.

BRICS+: From Concept to Geography

BRICS+ has transformed from an acronym into a geographic formation.

Today it includes:

the Gulf,

Africa,

South Asia,

and Eurasia.

Collectively representing:

nearly half the world’s population,

more than a third of GDP,

and dominant shares of global minerals and energy.

The point isn’t unity.

The point is a forum where Global South interests collide without being mediated by the West or overshadowed by China.

A single BRICS currency is unlikely.

A multi-settlement world is already here.

The Third Pole Takes Shape

When I step back, the pattern becomes clearer:

China builds the industrial systems.

India supplies diplomatic steadiness and digital capability.

The Gulf stabilises through capital and logistics.

Russia anchors resources, energy, and defence.

Africa brings demographic momentum and emerging autonomy.

This isn’t a bloc.

It’s a geometry — irregular, evolving, but functional.

And I feel countries are choosing this geometry not out of ideology, but because it gives them optionality.

Epilogue: The Distributed Century

The next century won’t be built on ideology. It’ll be built on corridors, minerals, energy, food systems, and digital governance. Countries will align with whoever protects their stability.

The Third Pole isn’t resistance.

It’s recalibration — the world steadying itself after decades of imbalance.

Δ ▽ ⧋

Dispatches | By Beyond Coordinates

© Beyond Coordinates 2025

This essay is an original piece of human authorship, verified through RADAR (0.01).

Data References

Eurostat (2024) – EU critical minerals & rare earth imports.

UN Population (2025) – Europe fertility rate 1.56; aging index > 130.

IEA (2025) – Russia oil & gas revenues ≈ $192 bn (2024).

IMF WEO (2025) – Russia GDP ≈ $2.3 tn; China ≈ $18 tn; India growth 6.7 %.

SIPRI (2025) – Russia defence spending ≈ 4.8 % of GDP.

Mining Technology (2024) – China controls 70 % of rare-earth output / 90 % processing.

Reuters (2025) – Rupee-Dirham & Rupee-Ruble settlement growth.

Bruegel (2025) – Oil-gas revenues ≈ 30 % of Russia budget.

G20 Communiqué (2024) – South-South finance and BRICS+ currency study.

IMF & OECD (2024) – EU industrial output –4 % YoY post-energy crisis.

△ ▽ ⧋

Every constellation is a conversation. Every orbit, a relationship in motion.