Salesforce + Informatica: When Data Becomes the Real Product

Inside Salesforce’s decade-long strategy to fix the part of enterprise systems no one wanted to own — and why it matters for AI, ISVs, and consulting partners | Cognitive Index 06

▲ ▼ ■ Cognitive Index | By Beyond Coordinates

I’ve followed Salesforce’s acquisitions for more than a decade, and this Informatica move felt different the moment I saw it. Not loud, not rushed — just a quiet attempt to fix the one layer of enterprise systems that causes 80% of delays, rework, and AI failures.

1. The part of the enterprise everyone avoids

Whenever I walk into a large organisation, I don’t have to look hard to find the real problems.

They don’t start in CRM.

They don’t start in ERP.

They start in the quiet, messy space between systems.

Every company I’ve seen struggles with things like:

CRM says 4,800 active customers

ERP says 5,200

Marketing claims 6,100

Service logs show something else entirely

This is normal.

Not good — just common.

In the healthcare and banking projects I’ve observed, the average enterprise runs 60–120 systems, each maintaining its own slightly distorted version of the truth.

So when Salesforce spent nearly USD 8B on Informatica, I didn’t see a “big acquisition story.”

I saw a company finally stepping into the layer everyone avoids because it’s boring, complicated, and absolutely critical.

2. MDM, without the jargon

MDM (Master Data Management) sounds like corporate vocabulary, but it’s really simple:

If five systems describe the same customer differently, nothing you build on top will ever work right.

Healthcare systems carry 8–20% duplicate patient records.

Banks maintain 20–40 versions of customer data across departments.

Insurers lose 30–40% of onboarding time to KYC/AML rework due to mismatched records.

Informatica’s job is to clean all of that.

They:

dedupe

validate

track lineage

unify identities

enforce trust

Now Salesforce is wiring this directly into Data Cloud — which already doubled usage year-on-year — turning it into the actual backbone, not the optional add-on.

I’ve always believed AI is only as good as the data under it.

Now Salesforce believes it too.

3. Salesforce has been laying this track for years

When I zoom out, the sequence feels intentional:

Heroku — build apps

ExactTarget — marketing engine

Demandware — commerce

MuleSoft — connect systems (now handling 1+ trillion API calls per month)

Tableau — understand the data

Slack — coordinate people

Own Company — protect data

Informatica — trust the data

The pattern is clean:

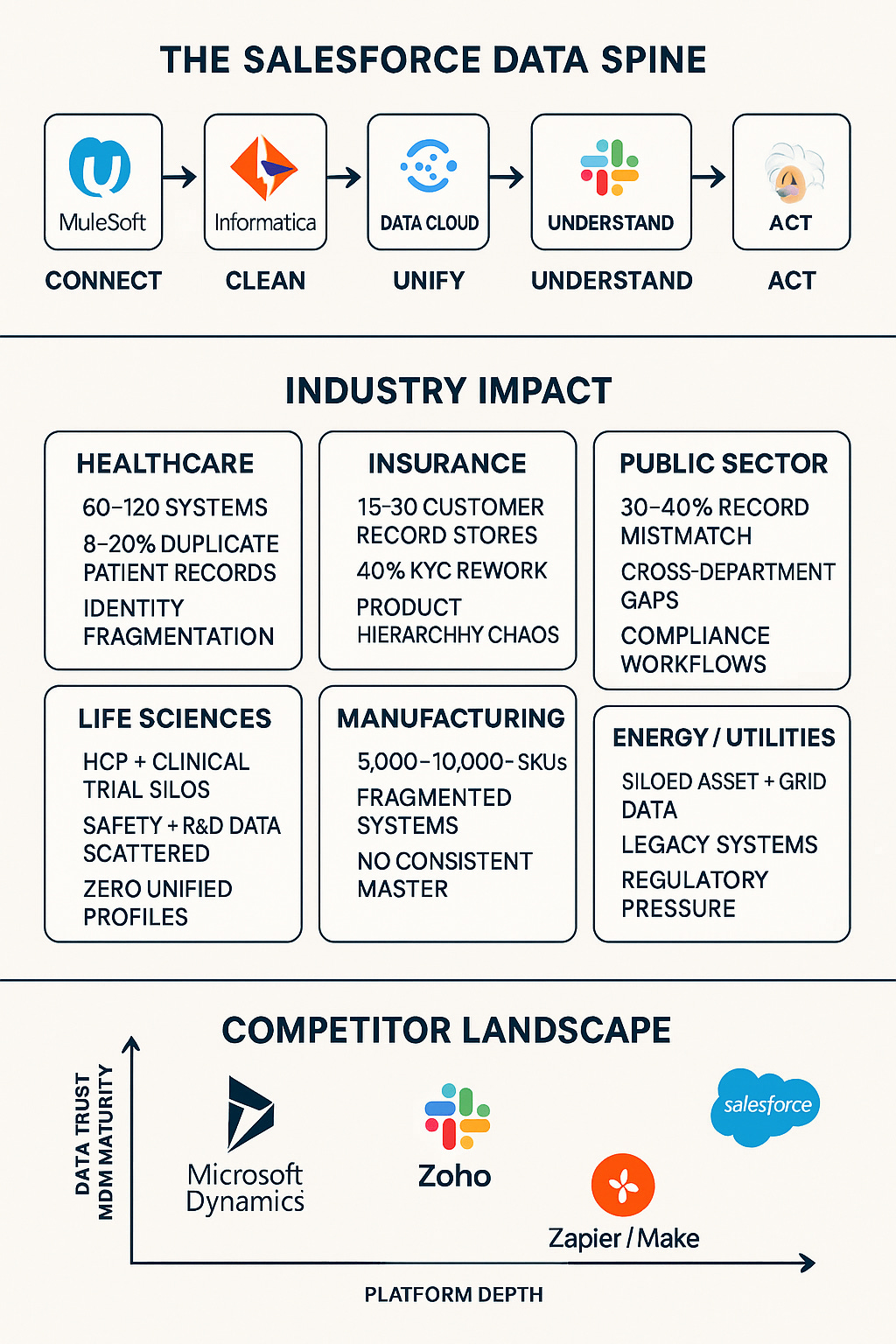

Connect → Clean → Understand → Collaborate → Act.

Informatica closes the structural gap Salesforce could never fill on its own.

Salesforce’s evolving data backbone: the integration layer, the trust layer, and the ripple effects across industries and rival platforms.

4. Salesforce’s Amazon move (but in enterprise systems)

Amazon didn’t win because it sold everything.

It won because it fixed the painful parts nobody tackled:

infrastructure

fulfilment

payments

reliability

Salesforce is playing a similar game inside enterprises:

mismatched data

brittle integrations

dashboards that contradict

APIs that break when a single field changes

AI models failing because of inconsistent inputs

With Informatica, Salesforce isn’t expanding — it’s stabilising.

This is infrastructure, not innovation theatre.

5. Low-code APIs and unlimited integration — finally real

For years, low-code and integration have sounded like promises.

But without clean data, they collapse under their own optimism.

Low-code APIs

Teams can create stable APIs without backend rewrites.

This matters because 70% of enterprise delays come from “API schema inconsistencies and broken sync logic,” not from strategy.

Unlimited integration

Integration stops being:

“we have 1,000 connectors”

…and becomes:

“things don’t break every time an upstream field changes.”

Manufacturers running 10,000+ SKUs, or retailers syncing millions of records, finally get predictability instead of patchwork.

It’s quiet, but it’s transformational.

6. The ripple for ISVs, SIs, and customers

ISVs (Independent Software Vendors)

AppExchange partners will now be judged on:

how they treat Salesforce’s master record

if they align with Data Cloud’s identity graph

whether their data models play well with Agentforce

if they reduce, not increase, duplicate records

This subtly raises the ecosystem’s quality bar.

SIs (System Integrators) & Consulting Firms

The shift is bigger than it looks.

Less of:

fixing sync failures

cleaning CSV dumps

maintaining duct-tape connectors

More of:

designing industry data models

cross-cloud architectures

governance frameworks

accelerators built on clean data

AI readiness consulting

The work moves from integration plumbing to systems thinking.

Customers

They finally get:

fewer rework cycles

consistent dashboards

predictable automation

cleaner analytics

AI that can actually trust its inputs

This is the first acquisition in years that directly improves daily enterprise life.

7. The Ecosystem Layer — Clouds, Industries, and Competitors I See Feeling the Heat

When I look across Salesforce’s clouds, the impact is immediate.

Marketing Cloud gets relief.

The average Marketing Cloud customer merges 5–12 data sources, which is why journeys often misfire.

Informatica cleans the inputs.

Journeys stop guessing.

Pardot (Account Engagement) finally escapes its long-standing duplicate lead pains — again, not because Pardot was flawed, but because the data feeding it was.

Marketo isn’t untouched.

Marketo is strong in enterprise B2B, but nearly 90% of customers bolt on Segment, Tealium, or custom identity tools.

Salesforce now has that layer natively — a real competitive advantage.

Data Cloud becomes the centre of gravity.

It becomes the identity graph + warehouse + activation layer instead of “just another cloud.”

Some industries get a rare reset.

From what I’ve seen, the biggest winners are:

Healthcare (60–120 systems; 8–20% duplicate patients)

Life Sciences (HCP + trial data fragmentation)

Insurance & BFSI (15–30 customer record stores per firm)

Manufacturing (thousands of SKUs, fragmented plants)

Public Sector (30–40% record mismatch between departments)

These industries finally get a data spine they can trust.

And the competitors? I don’t think they can ignore this.

HubSpot: Excellent UX; no deep MDM layer. Ceiling stays mid-market.

Zoho: Huge suite; consistency across 55+ apps is tough.

Dynamics: Strongest rival, but still missing native MDM.

Zapier / Make: They move data but don’t reconcile it — and the future requires reconciliation.

Every platform entering the AI decade has to solve the data-trust problem.

Salesforce just did it first.

8. The culture engine — Dreamforce, TrailblazerDX, DemoJam, Agentforce

I’ve always felt Salesforce doesn’t just build products — it builds alignment.

Dreamforce sets the story.

TrailblazerDX trains the builders.

DemoJams showcase compliant ISVs.

Partner Summits push SIs to change their offerings.

Agentforce demos show what “AI that actually works” requires.

When Salesforce repeats clean data + governance across all these stages, the ecosystem listens and then it evolves.

Informatica fits neatly into this rhythm.

9. Closing note

I don’t see the Informatica deal as Salesforce expanding its portfolio.

I see it as Salesforce taking ownership of the one layer nobody wanted to claim — the messy middle where systems disagree, integrations break, and AI fails quietly.

Amazon won by fixing the invisible pain.

Salesforce is aiming for the same outcome, just in a different world.

If this works, then by 2030 “using Salesforce” won’t mean CRM at all.

It’ll mean your organisation finally runs on one coherent truth instead of a dozen contradictory ones.

A small shift, but a foundational one.

Sources:

IDC Global Salesforce Economy Impact

Global Healthcare Duplicate Record Studies (HIMSS / AHIMA ranges)

CRM Market Share & Dynamics Ecosystem Reports

MuleSoft Public Transaction Volume Stats

Industry Analyses on Data Cloud, MDM, and AI Readiness

Human-generated content. Radar/GLTR pattern check: Passed.

Copyright © Beyond Coordinates, 2026