Retail Maximization: The End of Random Growth

How algorithms, thrift, and resilient systems are reshaping global consumerism

△ ▼ △

The Expanding Orbit | By Beyond Coordinates

This essay is part of The Expanding Orbit series at Beyond Coordinates.

Here, I examine how retail is moving away from excess and toward alignment. Not through slogans or technology hype, but through quieter shifts in visibility, inventory discipline, supply chain resilience, and recommerce.

The piece connects consumer behavior with system design, showing how decisions are shaped upstream and why misalignment has become a measurable cost. It is written for readers who want to understand how retail actually works now, not how it is marketed.

Epigraph

“Systems decide visibility long before consumers decide value.”

When I look at retail today, I don’t see slowdown.

I see restraint, structure, and a quiet re-ordering of how consumption works.

Prologue

For a long time, retail followed a simple logic:

more stores, more products, more choice.

I’ve watched that logic work — and then slowly exhaust itself.

Today, I notice shoppers hesitating longer. I see return rates rising. I see thrift stores spreading across cities that once celebrated only “new.” I also see retailers carrying less inventory, yet understanding their customers better than before.

What stands out to me most is this:

software increasingly decides what we see before we decide what we want.

Retail hasn’t slowed down.

It has become more deliberate.

This piece is my attempt to map that shift — away from excess and toward discipline, clarity, and system-level thinking.

Retail Is No Longer Growing the Old Way

Global retail sales are still rising, but I don’t see growth translating into comfort.

Margins are under pressure. Costs tied to logistics, energy, inventory holding, digital operations, and returns are rising faster than revenue in many markets.

What I see retailers focusing on instead is efficiency:

improving inventory turnover

reducing waste and markdowns

shortening planning cycles

increasing predictability

The central question has quietly changed.

It’s no longer “How do we sell more?”

It’s “How do we sell better?”

How Algorithms Quietly Shape What People Buy

Most people don’t feel it, but I think shopping decisions today are influenced long before intent forms.

I see it in everyday behavior:

product recommendations shaping discovery

search results ranked differently for different users

prices adjusting in real time

homepages changing subtly with each visit

Behind this sit tools many retailers now consider standard:

Search and recommendation systems like Algolia and Bloomreach

Personalization platforms such as Dynamic Yield and Adobe Target

Pricing and promotion systems like Revionics and Pricemoov

Customer data platforms like Segment and Tealium

These systems don’t push people to buy.

What I notice is that they reduce noise.

Data supports this:

roughly 60–70% of online purchases are influenced by recommendations

shoppers now see fewer products per session than a decade ago

retailers using personalization report 5–15% higher conversion rates

Retail is no longer about showing everything.

From what I observe, it’s about showing the right few things.

Retail maximization emerges when systems align before scale.

Retail Is Being Designed Around Decisions

When I compare retail now to even ten years ago, the shift is clear.

Earlier focus:

shelf placement

promotions

visual merchandising

Today, I see retailers obsessing over:

how quickly customers decide

where confusion appears

how demand aligns with supply

This explains trends I keep noticing:

smaller assortments

continuous planning instead of seasonal planning

forecasting that updates constantly

Retail performance today depends less on abundance and more on clarity.

Thrift, Reuse, and Sustainability Are Now Core Channels

I don’t see thrift as a fringe movement anymore.

Across categories, it’s becoming normal.

Clothing and fabric:

Resale platforms and buy-back programs are expanding. I see durability and quality being discussed more openly than novelty. Second-hand apparel is no longer hidden — it’s mainstream.

Electronics:

Refurbished phones and laptops are widely accepted. Warranty-backed resale has changed trust dynamics. What’s interesting is how resale pricing now influences new-product pricing.

Furniture and home:

Urban second-hand furniture markets are growing quickly. Rental and resale reduce logistics costs and waste. Longevity is becoming a selling point.

The numbers reinforce this shift:

recommerce is growing at 10–15% CAGR, faster than traditional retail

apparel resale alone is projected to cross $350–400B globally within the decade

thrift and resale stores continue expanding across regions

To me, this isn’t driven by marketing.

It’s driven by economics and awareness.

Supply Chains Are Now Judged by Resilience

The last few years made one thing obvious to me: cost-efficient supply chains are not always resilient ones.

Retailers that recovered faster did a few things differently:

they sourced from multiple regions

they built regional warehouses

they worked with flexible logistics partners

they sensed demand earlier

I’ve seen patterns repeat:

apparel sourcing split across South Asia, Southeast Asia, and Turkey

electronics production diversified beyond single-country dependence

furniture brands building regional manufacturing clusters

Data backs this up:

diversified supply chains recovered 30–50% faster from disruptions

lead times reduced by 15–25%

slightly higher buffers resulted in far lower losses

Supply chains are no longer optimized just for cost.

From what I see, they’re optimized for continuity.

Experience Has Become a Cost-Control Mechanism

I don’t view customer experience as branding alone anymore.

Poor experience creates very real costs:

higher returns

more customer support

weaker repeat behavior

Clear information, better sizing guidance, and simpler checkout flows reduce friction — and expenses.

Evidence shows:

returns are among retail’s largest hidden costs

small experience improvements can reduce returns significantly

repeat customers cost far less to serve than new ones

Good experience doesn’t just grow revenue.

It protects margins.

Too Many Tools, Not Enough Connection

When I look at most retail stacks today, I see abundance — and fragmentation.

Common issues I keep encountering:

data not flowing between systems

teams working in silos

promotions launched without inventory clarity

Typical outcomes:

demand created without supply readiness

customer service missing order context

planning lagging real behavior

Industry data reflects this:

integration costs now take up 20–30% of transformation budgets

simpler, better-connected systems consistently outperform complex ones

What I’ve learned is simple:

structure matters more than speed.

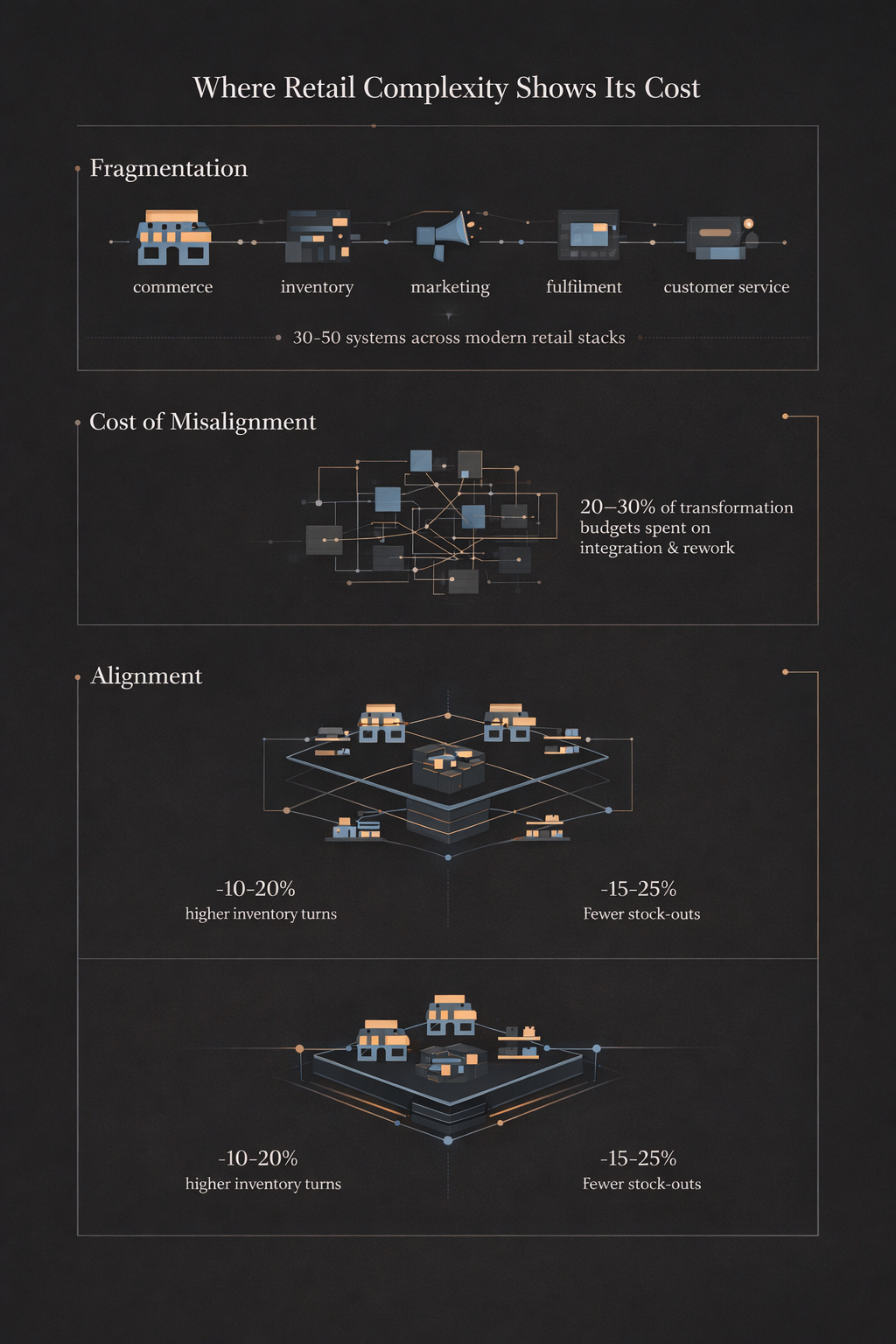

Where Retail Complexity Shows Its Cost

There’s a point where retail complexity stops being theoretical and starts showing up on the balance sheet. I see it most clearly when systems don’t align.

Globally, retailers now operate with 30–50 different software tools across commerce, marketing, inventory, logistics, and customer service. What surprised me when I first saw the numbers was not how advanced these stacks were — but how expensive their disconnect had become.

Studies consistently show that 20–30% of digital transformation budgets are spent not on new capability, but on integration, rework, and fixing gaps between systems. In practice, this shows up as promotions that outpace inventory, fulfillment delays despite strong demand, and teams relying on spreadsheets to reconcile what platforms cannot.

I’ve noticed a clear pattern among retailers that manage this better. They don’t add more tools. They simplify how tools work together.

When commerce platforms, inventory systems, marketplaces, and fulfillment logic are aligned, measurable changes follow:

10–20% improvement in inventory turnover

15–25% reduction in stock-outs

Lower return-related costs, especially in apparel and electronics

Faster rollout of new channels, including resale and marketplaces

This is where execution quietly matters.

Not as strategy.

Not as transformation theatre.

But as ongoing work that keeps experience, supply, and operations grounded in the same reality.

From where I stand, this layer has become unavoidable. As retail becomes more modular and more distributed, the cost of misalignment compounds quickly. The retailers that hold this together don’t necessarily look more innovative — they simply look more stable.

And stability, right now, is a competitive advantage.

Retail complexity becomes costly when systems grow faster than their alignment.

The Role of Modern Retail Solution Providers

I also see a new layer emerging in the retail ecosystem.

These are solution providers sitting between:

pure software vendors

large traditional consulting firms

They tend to:

focus deeply on retail-specific problems

combine boutique agility with enterprise delivery

work closely with business and technology teams

They help retailers with:

commerce architecture design

system integration and simplification

inventory and fulfillment alignment

resale and sustainability enablement

They don’t sell tools.

From my perspective, they help retailers make systems usable.

What Research Continues to Show

Across academic and industry research, a few patterns remain consistent:

too much choice leads to decision fatigue

simpler systems improve satisfaction and conversion

reuse and resale reduce waste without hurting demand

technology shapes behavior indirectly

Retail, increasingly, is guided by evidence rather than instinct.

Epilogue

Retail isn’t shrinking.

From where I stand, it’s maturing.

Algorithms, thrift, resilient supply chains, and simpler systems all point in the same direction — discipline over excess.

The future of retail will belong to those who:

respect consumer attention

manage inventory carefully

reduce waste

build systems that adapt without overreacting

Retail maximization is not about selling more things.

It’s about selling with intention.

Sources

McKinsey & Company — Retail personalization and supply-chain resilience reports

Boston Consulting Group (BCG) — Global retail and recommerce analysis

ThredUp — Annual Global Resale Market Report

World Economic Forum (WEF) — Global supply-chain resilience studies

© Beyond Coordinates, 2026

Human-authored content verified via RADAR / GLTR analysis.