Inside India’s GCC Flywheel (Part 2): From Talent Density to Innovation Gravity

India’s GCCs are no longer cost centers. They are strategic magnets — pulling talent back, attracting capital, and shaping the contours of the country’s innovation decade.

The Brain Gain Effect

For decades, India’s brightest graduates looked westward.

The story was one of brain drain — IIT and IIM toppers chasing Silicon Valley, Wall Street, or Singapore.

That narrative is beginning to shift. Not uniformly, but measurably.

Leadership Stints in India: Nearly 30% of Fortune 500 firms now require global CXOs to rotate through their India GCCs (NASSCOM). What was once a “support posting” is increasingly treated as a strategic credential.

Returnees in Action: Deloitte estimates that 12–15% of GCCs are now headed by leaders with global experience, many of them mid-career diaspora professionals choosing India over the Valley.

Networks Come Home: With every returnee comes access to venture funds, board relationships, and global clients — multiplying the ecosystem impact far beyond direct job creation.

Capital Follows Talent

Where capability clusters, capital compounds.

VC Office Density: A decade ago, India hosted fewer than a dozen global VC firms with on-ground partners. Today, over 85+ global VC and PE funds operate local teams — with Sequoia/Peak XV, Accel, and Lightspeed scaling their decision-making hubs in Bangalore, Gurgaon, and Hyderabad.

Deal Flow Shift: In 2023, startups founded by ex-GCC executives accounted for ~14% of India’s Series A deals. GCCs are becoming not just employers but founder factories.

Corporate Capital: MNCs reinvest heavily once GCCs hit scale. EY estimates $4 billion+ in GCC reinvestment in FY23, much of it into AI labs, cybersecurity centers, and digital twin platforms.

The pattern is clear: GCC density → talent credibility → capital stickiness → innovation momentum.

This does not cancel out the outflow of millionaires (over 6,500 HNIs left India in 2023). But it does create return channels that matter: reverse flows of expertise, networks, and credibility.

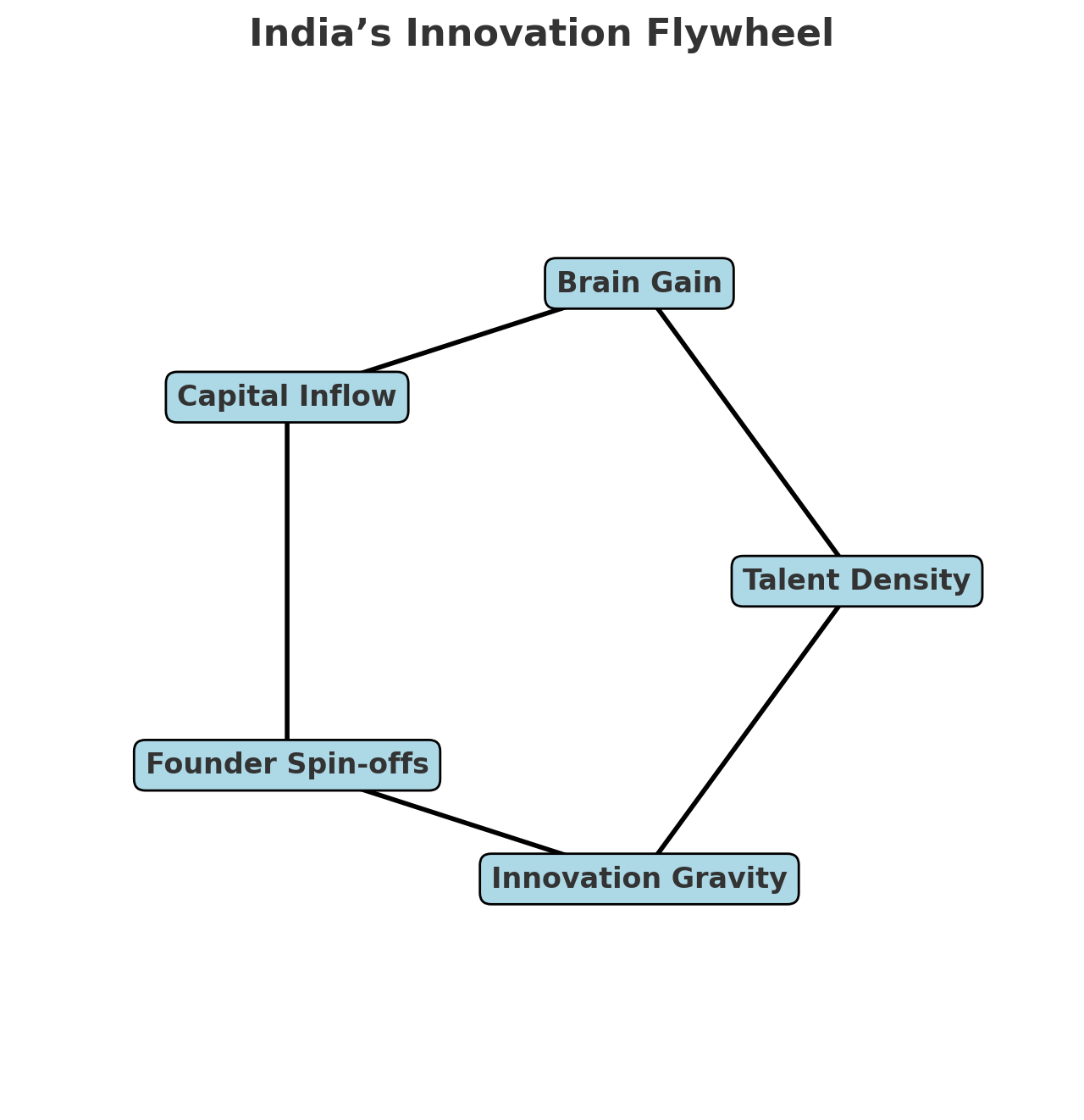

The Innovation Flywheel

Here’s how the upgraded loop is evolving:

Talent Density → India now has 1.9 million+ employed in GCCs, projected to reach 2.7 million by 2030.

Brain Gain → returnees and CXOs bring global networks and credibility.

Capital Inflow → VC firms, LPs, and MNCs deepen financial commitments.

Founder Spin-offs → ex-GCC talent creates SaaS, AI, fintech, and deep-tech startups — some scaling globally (Postman, Freshworks are templates).

Innovation Gravity → India moves from being the world’s execution hub to becoming a launchpad for next-generation category-defining firms.

This is no longer the outsourcing flywheel.

It is the innovation flywheel — and India sits at the nexus.

But Friction Remains

Momentum does not erase fragility.

Urban Strain: Bangalore’s commute speeds have collapsed to 18 km/h — lower than Manila — draining billions in productivity. Hyderabad and Pune already face water and housing pressure.

Talent Inequality: While GCCs absorb elite engineers, 45% of Indian graduates remain unemployable for knowledge work (India Skills Report 2024). The innovation economy risks becoming an elite enclave.

Policy Ambiguity: Data localization, AI governance, and startup taxation remain hazy. In 2023, $780 million worth of startup equity redomiciled to Singapore or Dubai due to taxation and compliance inefficiencies.

Value Capture: Over 75% of patents filed from India GCCs are still owned by parent companies abroad (WIPO). India risks becoming the factory floor of global IP rather than its co-owner.

The flywheel spins, but the friction is real.

The Road Ahead

For India to convert density into gravity, four imperatives stand out:

Infrastructure Backbone

Invest in urban transport, water, and energy resilience for current innovation hubs.

Benchmark: China spent $6 trillion+ in infrastructure (2007–2022); India’s ambition must match scale if GCC hubs are to sustain.

Skilling at Scale

Move beyond basic coding → advanced skilling in AI, quantum, cybersecurity, design, biotech.

Target: 5 million advanced digital workers by 2030, building a workforce for frontier domains.

IP Sovereignty

Incentivize patents filed and retained in India.

Without reforms, India risks remaining a contract executor rather than an innovation originator.

Geographic Fan-Out

Over 80% of GCCs remain concentrated in six metros (Bangalore, Hyderabad, Pune, Gurgaon, Chennai, Mumbai).

Policy incentives must fan out the next wave into Tier-2 and Tier-3 cities: Ahmedabad, Vizag, Kolkata, Noida, Kochi, Indore, Jaipur, Nagpur, Baroda, Coimbatore, Bhubaneswar.

Benefits: lowers operational costs, eases resource pressure on metros, catalyzes balanced regional development, and integrates new talent pools.

This redistribution is not cosmetic. It is essential if India is to create holistic innovation corridors rather than overburdened urban chokepoints.

Conclusion: The Decade to Decide

India’s GCCs have already changed the script — from cost centers to capability hubs.

Now they’re powering something larger: brain gain, capital inflows, and founder flywheels.

But the flows cut both ways.

Yes, HNIs exit to Dubai, Singapore, and the US.

But returnees also enter — CXOs, founders, VCs — reshaping India’s innovation canvas from within.

The real contest of this decade is simple:

👉 Can India make the return channels stronger than the exit ramps?

Because the future won’t be defined by whether India hosts GCCs — that is already settled.

It will be defined by whether those GCCs enable India to retain talent, capture IP, and convert sheer scale into sovereign innovation.

That’s the leap from talent density to innovation gravity.

This is Part 2 of our GCC series.

If you missed Part 1, read it here: Inside India’s GCC Flywheel: Where Talent, AI, and R&D CollideSubscribe to Dispatches by Beyond Coordinates for more deep dives into how India’s tech, talent, and geopolitics are shaping the next decade.