Gold, Silver, Copper and the Price of the World We Are Entering

Why preservation, transition, and construction are all becoming more expensive at the same time

Epigraph

Markets move faster than societies.

But societies feel the cost first.

Δ ▽ ⧋

Dispatches | By Beyond Coordinates

What I Started Noticing

Over the last year, I kept noticing something that did not feel routine.

Gold, silver, and copper were all rising at the same time.

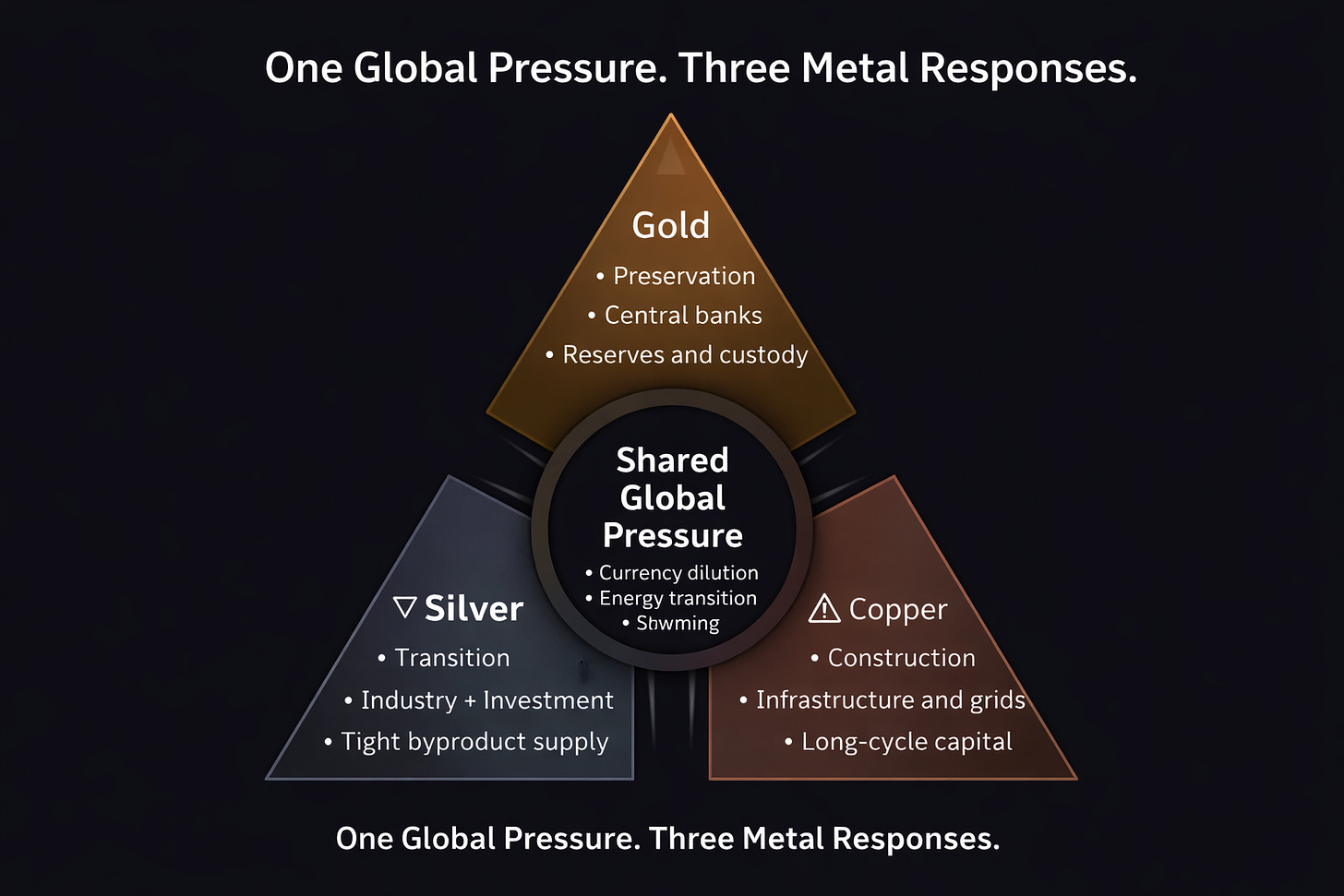

Individually, that is not unusual. Together, it made me pause. These metals serve very different roles. Gold is about safety and trust. Silver sits between industry and investment. Copper reflects real construction and infrastructure.

When all three move together, I do not read it as coincidence or speculation. I read it as a response to a shared pressure.

That pressure is not one policy or one event. It is a broader force shaping how value, security, and long-term commitments are being re-evaluated across the world.

This piece is not about predicting prices. It is about understanding what these metals are absorbing and why that absorption is starting to feel expensive.

Pause and reflect

When very different assets respond at the same time, I usually look for the common stress they are responding to.

Why This Is Not Just a Price Story

When I look past the numbers, I see a familiar pattern repeating.

Currencies have expanded faster than productive output. Geopolitics has become fragmented. Supply chains are being redesigned for security. Energy transition has moved from ambition to obligation. Infrastructure spending has shifted from optional to necessary.

These forces all point in one direction. The world is trying to preserve stability, manage transition, and keep building simultaneously.

Gold, silver, and copper respond differently, but they are reacting to the same underlying reality. Stability is harder to maintain. Transition is material intensive. Building takes time and capital.

Gold and the Rising Cost of Trust

When I think about gold’s rise, I do not think about consumption.

I think about custody and confidence.

Gold is rising because institutions are holding it differently. Central banks and sovereign investors are increasing gold exposure as protection against currency risk, geopolitical uncertainty, and fiscal imbalance.

As this happens, gold slowly moves away from everyday participation. I see jewelry demand soften even as prices rise. I see local discounts appear while global prices remain firm.

Over the past year, I have also noticed quieter signals closer to home. India has been gradually increasing the share of its gold reserves held domestically, reducing reliance on overseas custody in places like the UK and the US.

This is not a dramatic break from the global system. I see it as a recalibration.

For a country like India, holding more gold at home is about custody, sovereignty, and optionality. Gold held domestically carries no counterparty risk and no dependence on foreign balance sheets.

It does not change the global price.

But it tells me how states are thinking about resilience.

Pause and reflect

Trust still exists. I just see that it now comes at a higher cost.

Gold, BRICS, and the Quiet Shift in Power

When I zoom out further, gold’s rise starts to look less like a market phenomenon and more like a geopolitical one.

A growing share of global gold reserves and consumption now sits with BRICS nations. Collectively, these countries account for close to half of global gold demand and a significant portion of official reserves. This matters because gold accumulation at that scale is not about returns. It is about insulation.

At the same time, BRICS countries have been openly exploring alternative settlement mechanisms and reserve arrangements to reduce reliance on the US dollar. Whether these efforts result in a formal common currency or a looser trade settlement framework is still uncertain. What is clear to me is the intent.

Gold plays a central role in that intent because it is neutral, settlement-ready, and politically unaligned.

This shift becomes more understandable when viewed against the pressure on the existing system. The United States today carries federal debt in the range of USD 38 to 41 trillion. Servicing that debt alone now requires close to USD 1 trillion annually in interest payments. Alongside this sit long-term obligations such as social security, healthcare programs, education support, and defense spending.

Layer on decades of military and strategic engagements across Afghanistan, the Middle East, Africa, Ukraine, and other regions, and the fiscal picture becomes increasingly strained.

From where I sit, this does not signal collapse.

It signals stress.

In periods like this, gold stops behaving like a commodity and starts behaving like a balance sheet anchor. States do not rush into such positions suddenly. They accumulate quietly, steadily, and with long memory.

Pause and reflect

When power structures feel stretched, gold tends to move before currencies do.

Silver Between Industry and Capital

Silver is where I see the shared pressure become more complex.

Most people forget that silver is rarely mined on its own. It is produced as a byproduct of gold, copper, zinc, and lead mining. That makes supply slow to respond even when prices rise.

At the same time, I see industrial demand for silver continue to grow. Electronics, solar power, advanced manufacturing, and semiconductor-linked applications all rely on it. This demand is functional and recurring.

Silver also attracts investors because it feels close to gold psychologically, but behaves more like an industrial input. That combination tightens supply and increases volatility.

When I look at silver, I see a metal trying to serve two worlds at once. Investment demand and industrial necessity collide here first.

I also notice that silver inventories are far less transparent than gold, because silver lives inside industrial supply chains rather than central bank vaults.

Copper and Physical Commitment

Copper tells me something different.

When copper rises, I do not think about fear or hedging. I think about commitment.

Copper demand reflects grids being built, electric vehicles being rolled out, data centers expanding, transport systems being upgraded, and cities growing. These are not short-term narratives. They are long-cycle decisions backed by policy and capital.

Copper supply cannot expand quickly. Permitting timelines, environmental constraints, and capital intensity slow everything down.

When I see copper rising alongside gold and silver, it tells me the world is not just anxious. It is still building.

Pause and reflect

Copper does not respond to emotion. It responds to intent.

Why All Three Are Rising Together

When I step back, the pattern becomes clearer.

Long-term currency dilution has weakened confidence in paper value.

Geopolitical fragmentation has shifted supply chains toward security over efficiency.

Energy transition requires physical materials, not just policy statements.

Mining supply grows slowly by design.

Financial markets react faster than physical systems can adjust.

Each metal absorbs these forces differently, but the source is the same. The world is trying to do too many hard things at once.

Pause and reflect

What we are seeing is not a boom. I see it as a repricing of effort and stability.

The same global pressure is showing up differently across metals.

What This Means for India at the Household Level

In India, I do not see gold and silver as abstract assets.

They are woven into weddings, gifting, and family security. When prices rise faster than incomes, behavior changes quietly. Purchases are delayed. Jewelry becomes lighter. Financial substitutes grow.

I see emotional ownership shifting toward exposure rather than possession.

This is not just an economic change. It is a cultural adjustment happening in real time.

What This Means for Jewelers and the Value Chain

When I look at jewelers and wholesalers, I see pressure building on balance sheets.

Inventory ties up more capital. Working capital cycles stretch. Costs related to staff, security, compliance, marketing, and store experience continue regardless of demand.

The business moves away from scale and toward discipline. Inventory stops being passive and starts shaping financial resilience.

Pause and reflect

When prices stay high, I see velocity matter more than volume.

If Not Physical, Then What ?

As physical ownership becomes harder, I see alternate forms of participation growing.

Gold and silver ETFs offer price exposure without storage.

Sovereign gold bonds reduce holding costs while linking returns to gold prices.

Digital gold products allow fractional access.

Copper exposure is mostly financial through ETFs, futures, or equity-linked instruments rather than physical holding.

Each option solves a different problem. None replace cultural ownership, but they change how people participate.

Data Insert for Context

As of late January 2026, this is where prices stood.

Gold was trading around USD 4,900 to 5060 per ounce globally.

In India, retail prices were near INR 1.9 lakh per 10 grams.

Silver was near USD 107 to 111 per ounce globally.

In India, retail prices were close to INR 3.6 lakh per kilogram.

Copper was trading around USD 4.2 to 4.5 per pound globally.

What stands out to me is not just the level, but the speed at which these levels were reached.

Closing Thought

After spending time with gold, silver, and copper together, I do not come away with wonder.

I come away with decisions.

Gold tells me that trust is being centralized. When states and institutions behave this way, individuals eventually lose pricing power and access. Waiting for prices to normalize has historically not worked.

Silver tells me that transition is no longer theoretical. When an industrial input starts behaving like a financial asset, it usually means demand has outpaced planning.

Copper tells me that despite all the anxiety, the world is still building. Capital is being committed, not paused. That matters more than sentiment.

Taken together, this is what changes for me.

For individuals, this is not about chasing returns. It is about deciding how much exposure you want to preservation assets versus productive systems, and whether that exposure needs to be physical, financial, or hybrid.

For businesses in the metals value chain, this is not a pricing cycle. It is a balance-sheet test. Inventory strategy, velocity, and risk management matter more now than expansion.

For policymakers and institutions, this is a signal that resilience is being repriced faster than social affordability can absorb.

Gold, silver, and copper rising together is not a mystery.

It is a constraint.

The constraint is that stability, transition, and growth are all demanding capital at the same time.

Those who treat this as a temporary phase will react late.

Those who read it as a structural shift will adapt early.

That, to me, is the only real takeaway worth acting on.

If this piece changed how you think about metals, do one thing.

Revisit how much of your exposure is tied to preservation assets versus productive systems, and whether that exposure is physical, financial, or strategic.

If you are an investor, review allocation logic, not price targets.

If you are in the metals value chain, review inventory velocity, not expansion plans.

If you are a policymaker or strategist, review resilience assumptions, not forecasts.

This is not a moment to react.

It is a moment to rebalance thinking.

Observations in this essay are based on publicly reported market behavior and policy signals.

© Beyond Coordinates 2026 | Human-generated, GLTR/RADAR verified